Research: What does Savannah Fund accelerator applications show us?

Since 2012, Savannah Fund has hosted three accelerator classes with a total of 10 graduated startups. We’ve received over 300 applications from Ghana, South Africa, Nigeria, Uganda, Rwanda, the United States, Germany, etc.

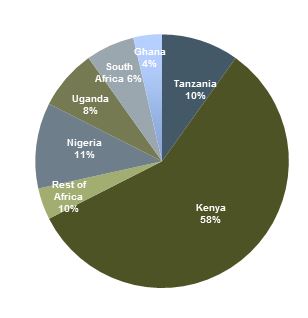

Here is the total distribution across Africa alone, with Kenya accounting for about half the applications:

There is a sharp drop in application numbers from our first (168 applicants) to second class (76 applicants), because we advertised globally for the first class. We decided to advertise only locally for the second class, because as Savannah Fund, we’re keen on investing in Africa-focused startups with local founders.

The way we advertised for the first class may have accounted for the drop of technical founders from the first class to second class. The 53.33% of applicants having a technical founder in the second class is more indicative of the actual percentage of African startups that have technical founders. While this percentage is fairly low, as we only invest in technical startups, the percentage increased from the second class to third class by .92%. A small change, but an increase nonetheless.

Of our total applicants, Kenyatta University (in Kenya) has the largest presence for university-stemmed startups. The University of Nairobi had the highest percentage in the third class with 7.4% over Kenyatta University’s 4.25% and Strathmore University’s 4.2%.

At Savannah Fund, we’re also very keen on making sure our startups have a web presence for a number of reasons. A web presence is vital for tech startups, because without one, how can you market out your product? It also confirms the legitimacy of a business and how serious the founders are if they spent time to create an AngelList, VC4Africa, or LinkedIn profile for their business. Savannah Fund is happy to see a decrease of applications with no web presence from class two to class three by 18.3%.

The state of the startups that apply from class to class has also changed. There has been a steady shift of startups that apply with just an idea to ones that have early customers. The number of applicants with early startups increased by 16.19% from class one to class three, while the number of applicants with just an idea decreased by 18.98% from class one to class three. Savannah Fund is hopeful that this means an increasing number of startups in Africa are growing into revenue generating companies.

The majority of startups from Kenya apply with a financial technology idea. The numbers have fluctuated from class to class: class one (14.46%), class two (6.82%) and class three (10.81%).