Which African country is best to do a tech startup? A Decision Framework

In recent conversation that have spanned the last 6 months, I’ve been getting the same style of questions from foreigners who recognize the growing opportunities in Africa and want to jump in. “Which is the best country in Africa to do a tech startup?” Sometimes the question is underlying in the comments I have seen in this blog “Hey, you talk so much about Kenya, what about Nigeria or South Africa- we rock too!”. But more recently the question is more vital when I get an actual startup or investor making a decision between 2 countries to launch their startup or to make investments. Or maybe down the line they realize there are better fortunes in another country- e.g. D.light Design, a darling of the impact investing industry, recently moved from Dar es Salaam, Tanzania to Nairobi, Kenya.

So where to launch a tech startup in Africa? There is no one right answer- what I want to offer here is a decision framework based on real data and trends that I have seen- this should help people assess their situation and move forward and get on with their startup. However picking a country to launch should not be taken lightly- This framework (more questions to ask yourself) can act as a guide to assess at each stage that is practical- for instance you may grow up in one country, but your needs mean you have to move to another country to take advantage of further opportunities that might restrict growth.

What Kind of startup Organization are you trying to build?

At pivot25 last year, I remember asking a kenyan lady who had a shirt business “this is a tech conference- what are you doing here if you are in the t-shirt business?”, she replied, “I am curious, I want to learn more”. Then I asked her “why are you selling t-shirts?”– she replied and I will never forget it “Look around, people wear second hand t-shirts from China or elsewhere all the time- Kenyans deserve much better”. This is the sort of entrepreneur attitude I like, she is very mission driven- and it also says a lot about the environment you are in and kind of organization she wants to build. Answering this question should get most people halfway to deciding where to do any startup and that includes tech. Each country in Africa has a unique offering for the kind of company you are trying to build- If you are importing materials or products you may want to be near a port such as Dar es Salaam or Mombasa, which one is easiest to deal with, which one offers the best road network to move your products? If you intend to build a tourism related company like when I started Yellow Masai, you want to be in an area with all the safari tour operators and major attractions- the angel investor actually owned a hotel on Kilimanjaro, this drove me to set up the company in Arusha, Tanzania- its also easier to hire talent that understand the tourism industry.

Look for strong Macro economic factors- but the right ones.

On the surface, the best countries in Africa for a tech startup are simply the ones with the best internet and mobile penetration figures, large middle class populations and fastest growing economies (GDP)- these include South Africa, Nigeria, Ghana, Egypt. But this is sometimes limiting.

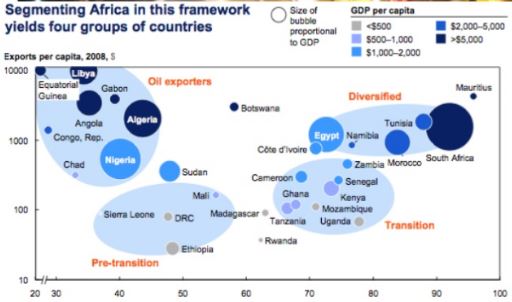

When I talked to Golden Gate University students last week, I used the Mckinsey diagram that segments countries to explain the dynamics of African countries and the implications. Exports per capita show the raw output and productivity of a country, the diversity of the economy shows essentially how much a country depends on mineral resources. Both taken together are extremely important and can help drive decisions. Nigerians like to say “hey, we are a bigger country and there is more money here- we are a big deal!”– but their economy is very dependent on oil exports- so much so that look what happened in the last week when fuel subsidies were removed and the price of petrol doubled. So what? Well it drives the expectations of that country and internal economy dynamics- a lot of talent is in the petroleum economy, why should talented folks leave and join your startup with no revenues when they can make more working in the established industry- money aside, maybe that programmer you are trying to hire in Nigeria would never leave that oil company because his parents expect him to get a steady job (in Oil), find a nice wife and settle down. I use Nigeria and oil to illustrate this example but it also applies to one other factor- dependence on AID. Some countries are so dependent on AID it makes up as much as half the economy- Tanzania is a good example here. But it also implies the sort of talent you can hire there- expats who expect a steady salary, drinks at the Yacht club every night and paid for driver to take them to and from work. In the bars you might meet a very attractive Swedish lady who when asked “what do you do?”– would reply “I am here to start an NGO and save Africa!” Again, the implications are clear- maybe she raised $100,000 in grant money and hires 5 people from the local University and then when they leave they expect the same sort of job at the next place- now imagine 10 more “I am here to save Africa with my NGO”-types, it spreads. An African country historically concentrated too much on one industry (especially natural resources such as oil- look up resource curse) can be very negative on their economy for trying new things- and tech is all about new ways of doing business and efficiency- so I am sorry, but more often than not AID industry professionals don’t cut it in the tech startup world, but I stand to be corrected.

Check out South Africa on the chart- No wonder over half African investment in private equity ends up there- its both a big country, well diversified with high export earnings- its hard not to consider South Africa for a tech startup on the continent- but even this masks other considerations before one should jump into a country.

If you are building a social enteprise and raising impact investing capital, you may actually benefit from looking at other metrics beyond which countries are the richest, but which countries have the most NEED and hence your possible impact. For instance, where is malaria having the biggest infection rates if you are doing an mhealth app around this problem? The countries that have the most need tend to be the ones that have the worst macro economic conditions- I recently learnt that malaria has been responsible for 1% negative GDP growth African countries have experienced in the last 50 years- no wonder Bill Gates is investing his money to make an impact in this area.

Watch for Barriers, Regulatory Environment that might open or block Market Access to a country that might otherwise look lucrative

Despite my concerns about economic diversifcation, when you look at raw market size, numbers can also be deceiving. Nigeria is absolutely the single biggest African market right now with a population of 160M and with over half that with mobile phones- its lucrative indeed. But down the line the East African Community (EAC) presents a potential 120M people between the member countries Tanzania, Kenya, Uganda, Burundi and Rwanda- and a possible single currency soon. Size of a single country is not the only thing that matters (yes its true!), market access does. Take mobile banking- in Kenya you have 15M people mobile users with M-PESA and 7 transactions a second. Whilst in Nigeria, there are supposedly 11 mobile banking companies that are operating and the regulatory environment meant that they had to apply for those licenses. The potential for mobile money in Nigeria is certainly huge, but its still very early and without a strong agent network and being so fragmented, its hard for mobile money to see the growth and success that Kenya does right now- when half of adults use one system- regulation has hindered the growth of mobile banking thus far and once licenses were released- 11 services jumped into the market. That being said, Nigeria is forecasted to hit 20M mobile banking users by 2015.

Another example on regulation is Tanzania’s very odd 18% VAT phone tax which has been abandoned by neighboring countries. What is strange is that there are no such taxes on traditional PCs – I once saw someone on a mailing list in Tanzania ask someone who was going to Kenya whether they’d buy for them 10 Android smartphones so they can avoid the high prices in Tanzania- the tax makes a difference for higher end (smart)phones. Phone manufacturers like Nokia and Samsung absolutely hate this since it denies them a chance to sell higher profit margin phones where they will make their money in the future. The point is, Tanzania smartphone penetration which is strongly correlated to mobile web access may remain stubbornly low compared to its neighbors. And the data when digging deeper shows this (but of course, other factors do play like the higher GDP per capita)- New Government stats show that whilst Kenya only just edges Tanzania in mobile penetration (68% vs 45%), the web penetration gap is much wider by 3 times (36% vs 11%).

Support Network, Doing Business & Entrepreneurial Ecosystem

An energy startup founder pondering which lawyer to work with recently told me that the 2 lawyers she had talked to had a 25 to 1 difference in pricing to incorporate their company! The exact no.s were $25,000 vs $1,000. Yikes! I responded “Welcome to Tanzania”. This illustrates how hard it is to do business in Tanzania from a very serious decision of which lawyer to use- who you know and work with matters tremendously, or risk being ripped off or cost prohibitive for foreigners to enter.

Similarly- closer to tech, hubs are now popping up all over Nairobi inc. the iHub and Nailab- it is now getting “cooler” to hang out at these spaces and bump into likeminded people with a community- peer to peer networking as well as regular visits from investors and tech industry, mentors and officials. In short, tech workspaces like the iHub backed by the industry make doing business in technology much easier not to mention bringing legitimacy to the tech scene in the country. Nigeria just opened up their first workspace end of last year, Co creation Hub, last year- a fragmented tech scene does not help investors and likeminded people trying to connect with each other. South Africa has a number of spaces and initiatives around Silicon Cape and when coupled with talent it helps launch your startup faster. Word of caution- in contrast some workspaces or incubators are heavily influenced by the world bank or government bodies such as in Senegal, Tanzania and Rwanda- whilst an incubator is better than no incubator at all, one that fosters a strong community and doesn’t feel like a “big brother”/Government is watching – i.e. best run by the private sector or at least not too influenced by Government, makes the most sense.

Another factor of the ecosystem is expectations of investors and valuation of technology and startups. Because of the understanding of the impact of technology in the economy, some investors make unreasonable demands on startups such as asking for 50% equity stake of a business for a very small valuation. Closely related is the willingness and comfort of big companies to buy startups at decent valuations to provide a return to investors and especially the entrepreneur for taking the risk in doing a startup- we have seen little to almost none of this appreciation in Africa to date, but global companies like Visa with the recent acquisition of Fundamo may begin showing the way. You can bet that technology startups will disrupt banking and media and other industries in Africa as the internet has in the rest of world, how quickly do the incumbent companies recognize this and pay for innovation or suffer a death from the disruption? Countries that encourage this and hence coordinate the entire ecosystem end to end will have a more dynamic IT industry.

Competitive Dynamics

Whist Tanzania may not be as business friendly as our Kenyan neighbor- there are generally less competitors for that market for a given sector- this can be a significant advantage. Note that with the EAC such advantages will erode away just as it happened in the Euro as free movement of labor, capital and good makes it easier to transact across the region. Tanzanians need to shape up fast or they will see Kenyans or other EAC members eating their lunch. A lot of middle managers in Tanzania frequently come from Kenya. At the same time lack of competition is also a bad thing, for instance the example of the $25,000 fee to incorporate stems from the fact that there are very few qualified lawyers in the country and most focus on the big concentrated industries such as mining with little regard for the needs of startups.

Unique industry advantages & Startup Lifestyle

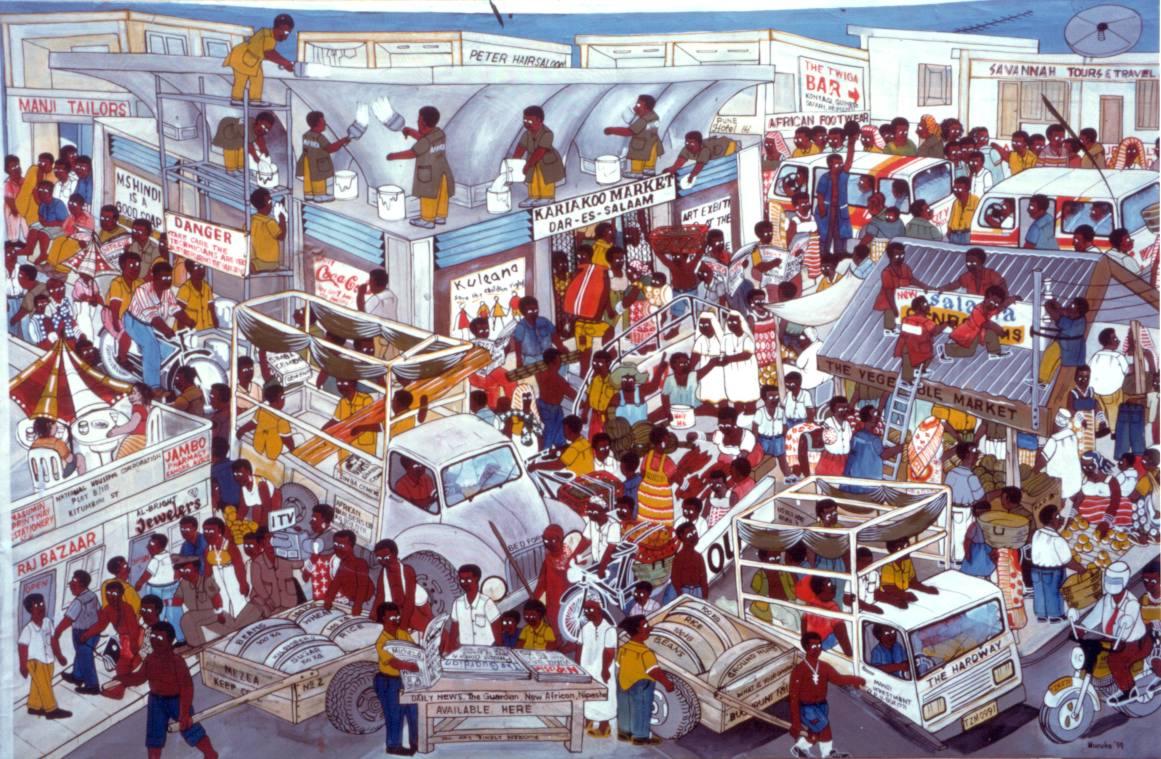

I’ve slammed Tanzania (disclosure: I am Tanzanian) quite a bit- but it does have some unique benefits related to lifestyle. When I am working in Dar es Salaam and I am very tired, I can take a $10 2hour ferry ride or $70 flight in 20 mins if I am in a hurry and be in total paradise. Zanzibar is such a laid back place- one long weekend there and I am fully refreshed, its a great place to go recover and sometimes my best thinking over the last 10 years has been there because I spent time to recharge. I always tell my US friends- that $1 spent in Zanzibar is probably equivalent to $10 of luxury I would spend anywhere else. I mention this because it is important to maintain a good work-life balance. One of the reasons Silicon Valley is so great is because it has amazing weather and offers access to a variety of outdoor activities- you can go snowboarding one day and surf the next. Aside from living a nice life, there are obvious opportunities in tourism but also trade- did you know that the kariakoo market in Dar es Salaam is one of the biggest markets for imported products in East Africa? Access to the Dar es Salaam port recently has made this a big trading area. Merchants come as far as Rwanda, Malawi, Burundi and Zambia to buy everything from flat panel LCD screens to clothing.

Another factor related to lifestyle is expectations of startup ambition- many investors claim that in many parts of the emerging market too many entrepreneurs have aspirations to build a family business and have no expectations that their investors to which they raised money from who may want to see an exit (whether acquisition or dividends). VCs don’t fund family businesses- they are looking for big regional if not global businesses. The sort of startup life you want and who you want to draw investments from can impact where you need to be. One of the reasons I left yellowmasai, the travel website (yes, I am no longer involved) was because the investor’s expectations were different from mine and the investor wanted to just address the Tanzanian market not go regional which would require new outside investment or go head to head and compete with other companies. This point is closely related to “the kind of organization you want to build” which in turn informs the sort of investor you want to attract and ultimately where you are likely to find this.

South Africa may win here given their links to the global market, talent and investors that expect this. Take a recent conversation I had with South African serial entrepreneur Vinny Lingham about where he finds seed investors- he has learnt to always try raise money in Silicon Valley because it aligns his expectations of the kind of returns and hence the kind of organization he wants to build. Even though South Africa is an excellent market, it has some of the access to angel investment problems common to all the regions in Africa and indeed many countries around the world except Silicon Valley. Having been in the Silicon Valley region for a number years, you see countries as diverse as Finland, UK, Brazil, Singapore, Netherlands, Norway, Canada, Chile come flocking here to learn from the best and become more competitive- some very proactive governments even have technology trade missions or offshore hub/embassies here to help the startups from their region- example is the new innovation house Norway. When will African countries begin to do this? Of course not every country can afford it- the next best thing is to send delegations, like the Kenya ICT board did last year and in previous years- it can also help mobilize diaspora talent that there are opportunities at home-talent that can join your startup!

Be Global: Take advantage of all the countries and their diversities.

The best startups treat the world as flat, and from day one are opportunistic about where they source customers, talent and investors. The most diverse networked entrepreneurs will do best. Apple designs and markets in California and manufactures in China. Tablets can be designed in Nigeria and manufactured in China too. Lets promote more regional trade within Africa to help each other out- it is exciting that Kenya’s M-PESA has inspired other startups and even big companies to try replicate their success.

One country that stands out a lot for financial access, doing business and transacting across the continent and indian subcontinent is Mauritius. It offers some of the best tax advantages thanks to its treaties with numerous African countries and has transformed itself as a financial hub, a lot of it has to do with its political stability over the years and Government push to be able to do this (note: its a very diversified economy based on the chart I pointed out earlier). Botswana with its International Financial Services Centre is trying to be a financial hub too given similar advantages and ambitions. I think startups that grow in substantial size and start expanding across the region might think about reincorporating their startups in hubs such as Mauritius, Botswana or South Africa- especially if there is a remote chance of getting acquired by a multinational company or they want to float on a public exchange via an IPO.

Promote your own country and don’t be afraid to enter others

As readers may know, I am very biased towards East Africa. I don’t speak French, Portuguese or Arabic to be able to navigate the other half of the huge and diverse parts of Africa, but I am eager to learn- I hope I have demonstrated that there is diversity and no one country is the only place to launch a startup. I expect more country advocates to step forward and put forward their case for why their region of Africa is uniquely positioned to do a startup. I have friends in many other African countries and I always seek to be educated about the opportunities there for the sectors I am interested in. This brings me onto a final and important point- the country you should enter almost always the entrepreneur needs to understand intimately all these factors and in particular people who can guide them through the unique environment- many emerging markets countries including Africa have unique cultural and business practices that are best understood by working closely with trusted people. Great people make startups work not just huge metrics. Don’t be like this guy for example who only spent 6 months in Chile and concluded that Chile was not fit for startups– more that Chile did not accept him because he was not patient enough to find the opportunities. I strongly believe comfort and familiarity and a healthy appetite for risk make most places in the world ripe for startups. Remember, if Mo Ibrahim can start a mobile operator in the Congo, then why not elswhere? Also like D.Light, don’t be afraid to move on as your startups needs grow to exploit new opportunities- whether its going to Mauritius, Nigeria, South Africa, Malawi (heck try South Sudan!) or Silicon Valley to support the growth of the venture. Partnering with other organizations both within Africa and beyond you build a trust with in other countries can help you . Most of all, remember, what kind of startup are you trying to build?